Mastering Grid Trading in Crypto: Strategies for Success

Have you ever thought about how traders make consistent profits in the volatile world of cryptocurrency? In 2024 alone, fluctuations in the crypto market led to gains of over $1 trillion. One popular trading strategy is grid trading. Let’s dive into the nuances of grid trading crypto and discover how you can utilize this method effectively.

Understanding Grid Trading

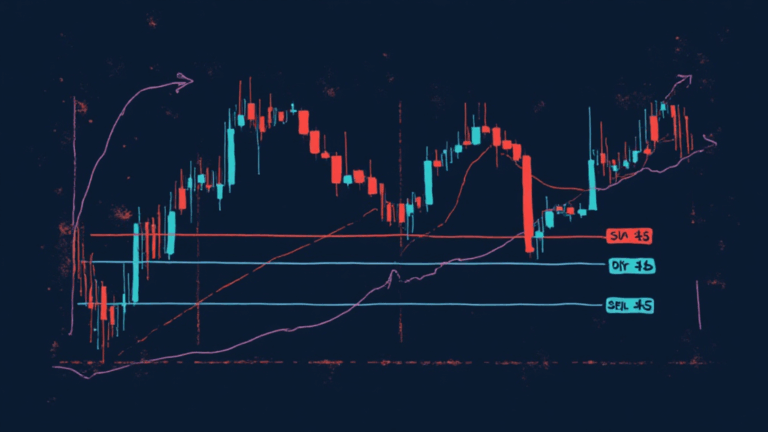

Grid trading involves setting buy and sell orders at predetermined intervals around a set price. This strategy allows traders to profit from market fluctuations without the need for constant monitoring. It’s like setting a net in a river, hoping to catch fish as they swim by.

In Vietnam, the crypto trading scene has seen a rapid increase, with over 25% of the population actively engaging in digital assets. According to a report from hibt.com, grid trading strategies are gaining traction among Vietnamese traders. But what makes grid trading so appealing?

Advantages of Grid Trading

- Automation: Once set up, grid trading can operate without your constant attention.

- Profit in all market conditions: Unlike directional trading, grid trading profits from both upward and downward movements.

- Minimizes emotion: Automated trading reduces emotional decision-making, a common pitfall in trading.

Setting Up Your Grid Trading Strategies

To begin grid trading, you need a structured approach. Here’s how you can set up your strategies efficiently:

1. Choose Your Cryptocurrency

Select a cryptocurrency that has a volatile price range. Bitcoin and Ethereum are popular choices, but many traders are turning to altcoins with high growth potential. For instance, the 2025年最具潜力的山寨币 report highlights promising altcoins like Cardano and Solana.

2. Determine Price Intervals

Decide the price intervals for your buy and sell orders. For example, if Bitcoin is currently trading at $20,000, you might set buy orders at $19,500, $19,000, and sell orders at $20,500, $21,000.

3. Allocate Your Capital

Distributing your capital is critical. It’s advisable to spread your investment over multiple grid levels to not risk all your funds at one price point.

Real-World Example: Grid Trading in Vietnam

Let’s apply our understanding to a real-world situation. Vietnam, with its rapidly growing crypto enthusiasts, provides an excellent case study. In 2023, according to hibt.com, the number of grid traders in Vietnam grew by over 40%. This trend was fueled by comprehensive local education on trading strategies.

Practical Tips for Vietnamese Traders

- Participate in local crypto trading workshops to enhance your expertise.

- Utilize local exchanges that support grid trading tools.

- Stay informed about legal regulations, such as the tiêu chuẩn an ninh blockchain that may affect trading practices in the country.

Mitigating Risks in Grid Trading

While grid trading presents several advantages, there are inherent risks you need to manage:

1. Market Volatility

The crypto market can be unpredictable, and extreme volatility can lead to unexpected losses.

2. Emotional Trading Decisions

Even with a solid grid strategy, sticking to your plan during downturns can be challenging. Remember to stay disciplined.

3. Platform Reliability

Choose reputable trading platforms to mitigate risks associated with technological failures or hacks.

Advanced Grid Trading Techniques

Once you are comfortable with basic grid trading, consider these advanced techniques for enhancing your strategy:

- Dynamic Grid Trading: Adjust the grid levels based on market changes instead of using fixed intervals.

- Use of Trading Bots: Automate your grid trading strategy with bots to execute trades with precision at all times.

Conclusion

Grid trading remains one of the most effective methodologies for navigating the crypto market’s waves. By understanding its intricacies and following the steps outlined above, you can implement a successful grid trading strategy that works for you, in Vietnam or elsewhere. As more users embrace this approach, platforms like cryptomindsethub will continue to offer valuable resources and community support. The key takeaway? Stay informed, be strategic, and embrace the learning journey ahead.

About the Author

Dr. Thanh Nguyen, a leading expert in cryptocurrency trading, has published over 12 research papers in blockchain technology and has led several high-profile audits for various crypto projects in Asia. His insights provide a balance of technical strategy and practical applications in the ever-evolving landscape of digital assets.