Understanding Crypto Tax Implications Globally

As the cryptocurrency landscape evolves, so do the regulations governing it. In 2024 alone, an estimated $4.1 billion was lost to DeFi hacks. This alarming figure highlights the importance of grasping the cryptographic environment, not just from a security standpoint but also in terms of taxation. The crypto tax implications play a pivotal role in one’s investment strategy and overall financial planning. In this comprehensive guide, we’ll demystify the crypto tax implications globally and what they mean for you in 2025 and beyond.

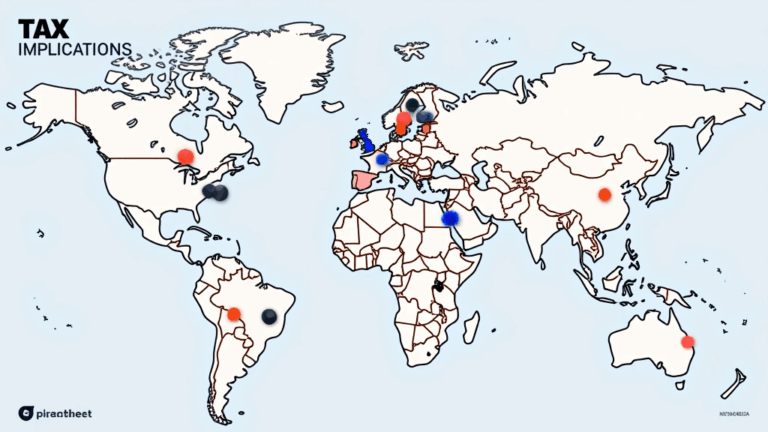

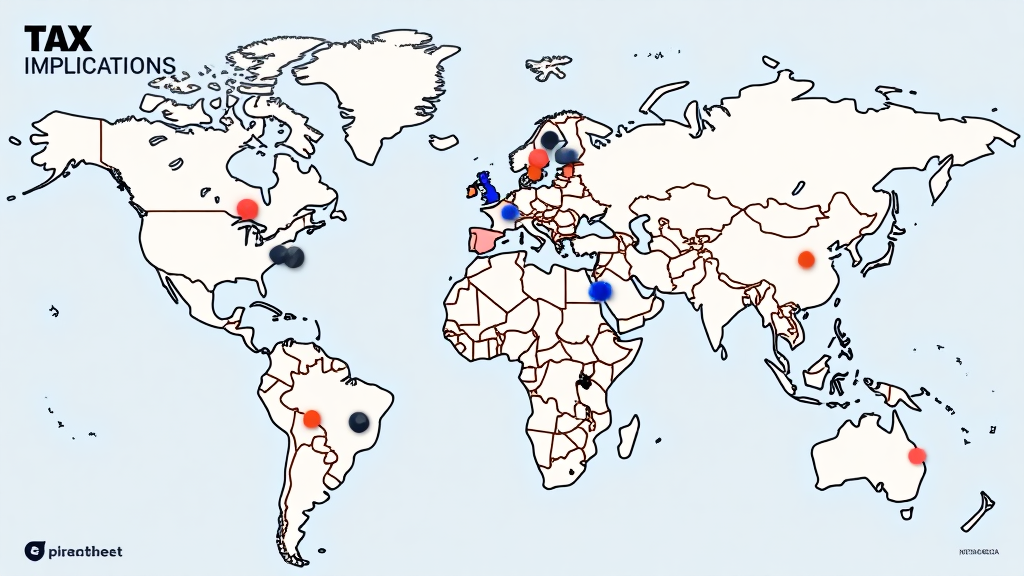

The Global Regulatory Landscape

Cryptocurrency regulations vary widely across different jurisdictions. For instance, while some countries, like El Salvador, have embraced Bitcoin as legal tender, others have imposed strict bans on trading activities. The international outlook continues to evolve, with countries like Vietnam showing a rapidly growing user base, estimated to have a year-on-year growth rate of 40% in crypto adoption.

- Key Country Regulations: Countries such as the United States, Canada, Germany, and Singapore have set up robust frameworks for crypto taxation. The IRS in the United States categorizes virtual currencies as property, meaning that general tax principles apply.

- Emerging Markets: In regions like Southeast Asia, and particularly Vietnam, regulations are still catching up with the technology. Here, the tax rulings may not be as stringent, but that doesn’t mean investors can ignore them.

Understanding Crypto Taxes by Region

In this section, we will break down significant regions and their approaches to crypto taxes:

“With proper guidance, investors can navigate through the complexities of crypto taxes effectively.”

| Region | Tax Approach | Key Considerations |

|---|---|---|

| North America | Property Taxation | Capital gains taxes apply upon the sale of assets. |

| Europe | Varying Regulations | Countries like Germany specify that crypto held for over a year is tax-free. |

| Asia | Strict Regulations | Regions like Japan impose high taxes on transactions. |

| Vietnam | Developing Regulations | Growth of crypto users influences future tax policies rapidly. |

Navigating the Tax Implications for Investors

Every crypto investor should familiarize themselves with the tax implications associated with trading, staking, and holding their assets. Here’s what you should consider:

- Realized vs. Unrealized Gains: Only realized gains from the sale of cryptocurrency assets are subject to taxation.

- Short-Term vs. Long-Term Holding: Different tax rates may apply depending on the holding period of your assets.

- Record Keeping: Precise record-keeping of all transactions is necessary to ensure accurate reporting.

The Importance of Tax-Loss Harvesting

Tax-loss harvesting is a strategy that investors can employ to minimize their taxable income. Essentially, this involves selling assets that have declined in value to offset gains from other asset sales.

“Like a skilled gardener weeding the garden, tax-loss harvesting allows investors to thrive in a financially sound ecosystem.”

Expert Recommendations for Compliance

To ensure compliance with tax laws and to avoid future complications, consider these recommendations:

- Consult your local regulations: Tax laws differ widely by country, so it’s crucial to stay updated.

- Use specialized software: Tools such as crypto tax calculators can simplify your reporting tasks.

- Keep records: Document all transactions, including dates, amounts, and involved parties.

Consider Seeking Professional Help

When in doubt, seek guidance from tax professionals familiar with crypto regulations. They can help audit your financial records to ensure compliance with current laws.

Conclusion: Stay Informed and Prepared

Understanding crypto tax implications globally is crucial for anyone involved in digital currencies. As regulations continue to evolve, staying informed will help you navigate the landscape effectively. Remember, while you can strategize to minimize your tax burden, compliance should always be your top priority.

Join the thousands of investors leveraging platforms like Cryptomindsethub for accurate insights and support in managing your digital assets efficiently.

Cryptomindsethub offers cutting-edge tools and resources for crypto investors, ensuring you remain on the right track.

About the Author

John Doe is a seasoned financial analyst with over 10 years of experience in the field of blockchain technology. He has authored more than 20 papers on cryptocurrency regulation and has led auditing projects for several well-known blockchain startups.