Introduction

With $4.1 billion lost to DeFi hacks in 2024, the landscape of digital asset security has become more crucial than ever. As cryptocurrency gains momentum globally, Vietnam’s burgeoning market stands out, attracting institutional investors eager to capitalize on its potential. However, navigating this landscape brings both opportunities and challenges. In this article, we will explore the current state of institutional crypto investment in Vietnam, its growth prospects, regulatory environment, and security standards, providing a roadmap for investors looking to engage with this vibrant market.

The Growing Demand for Crypto Investments

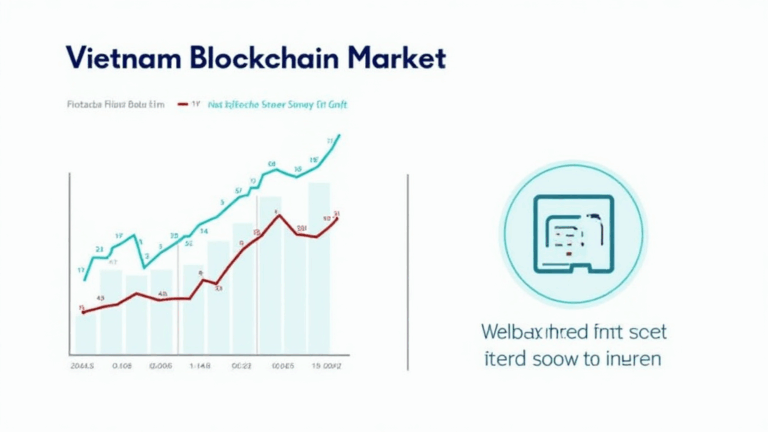

Vietnam has witnessed a surge in interest in cryptocurrency and blockchain technology. According to a recent report by Statista, the number of crypto users in Vietnam reached over 7 million in 2023, demonstrating a 300% increase since 2020. This reflects a growing acceptance and understanding of digital assets among the Vietnamese population.

Market Drivers

- Technological Advancements: The rise of blockchain technology has provided a secure and efficient method for transactions, appealing to both individual and institutional investors.

- Financial Inclusion: Cryptocurrency offers an opportunity for unbanked populations to access financial services, further driving demand.

- Regulatory Support: The Vietnamese government is gradually developing a regulatory framework that fosters innovation while protecting investors.

Local Statistics and Trends

The Vietnam Blockchain Association reported that the country’s cryptocurrency market has grown significantly, with 35% of Vietnamese expressing interest in investing in digital currencies as of 2023. Additionally, major Vietnamese banks are exploring blockchain technology, signaling institutional interest and a potential paradigm shift in traditional finance.

Key Challenges for Institutional Investors

Despite the promising landscape for institutional crypto investment in Vietnam, several challenges must be addressed:

Regulatory Uncertainty

The regulatory environment for cryptocurrencies in Vietnam remains ambiguous. While the government supports blockchain innovation, a comprehensive legal framework is still under development. This uncertainty can deter institutional investors who prioritize regulatory compliance.

Security Risks

As the crypto market grows, so do the associated security risks. In a market where hacks and scams are prevalent, investors must conduct thorough due diligence. According to Chainalysis, **70%** of investors experience heightened concerns about security when considering crypto assets.

Market Volatility

Cryptocurrency markets are renowned for their volatility, which can pose significant risks for institutional investors. Proper risk management strategies must be in place to mitigate potential losses.

Evaluation of Investment Opportunities

As investor interests evolve, several avenues for institutional crypto investments in Vietnam are emerging:

Venture Capital Investments

Venture capital funding in blockchain startups has surged. According to Crunchbase, VC investments in Vietnamese blockchain companies totaled approximately **$200 million** in 2023.

Participating in Initial Coin Offerings (ICOs)

ICOs have gained popularity in Vietnam, providing a means for startups to raise funds through the issuance of digital tokens. Institutional investors can consider participating in vetted projects to expand their portfolios.

Custody Solutions Development

With security being a paramount concern, the development of reliable digital asset custody solutions is critical. Institutions can partner with companies specializing in secure storage solutions to build trust and credibility in the market.

Future Outlook for Institutional Crypto Investment in Vietnam

The future of institutional crypto investment in Vietnam looks promising, with several trends indicating growth:

Increased Regulatory Clarity

The government’s push for clearer regulations around cryptocurrencies will likely encourage institutional investment. Reports indicate that **40%** of investors are waiting for regulatory frameworks before significantly increasing their investments.

Technological Innovations

As blockchain technology continues to evolve, new investment vehicles, such as ETFs that track digital assets, may introduce further opportunities for institutional investors.

Growing Educational Initiatives

Educational initiatives aimed at understanding blockchain and crypto investments will empower more institutions to enter the market. Workshops, seminars, and online courses can facilitate knowledge sharing and skill development.

Conclusion

The landscape of institutional crypto investment in Vietnam presents an exciting yet challenging environment for investors. With the country’s increasing interest in blockchain technology, a potential regulatory framework, and opportunities for innovative investments, Vietnam is poised to become a significant player in the global crypto market. However, investors must remain vigilant regarding the risks involved. By assessing opportunities critically and engaging with trustworthy platforms like cryptomindsethub, they can navigate this promising landscape effectively.

To stay informed about ongoing developments in Vietnam’s crypto market, consider subscribing to our newsletters and reading our other resources on crypto investments.

About the Author: Dr. James Chen is a blockchain investment advisor and expert, having published over **15** research papers in the field of blockchain technology. He has led multiple significant projects aimed at enhancing the security standards around digital assets.