Introduction

In the world of cryptocurrency trading, understanding the various order types is vital for optimizing your trading strategy. With the growth of digital assets and the increasing complexity of trading platforms, traders must grasp the intricate details of order placements to maximize profits and minimize risks. Did you know that in 2024 alone, approximately $4.1 billion was lost due to trading errors? This emphasizes the importance of understanding order types.

This guide will delve into HiBT order types, ensuring that you equip yourself with the knowledge necessary to navigate the dynamic marketplace successfully.

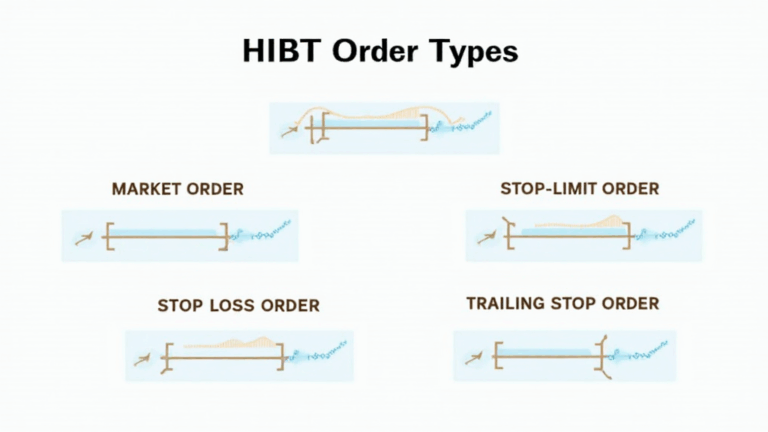

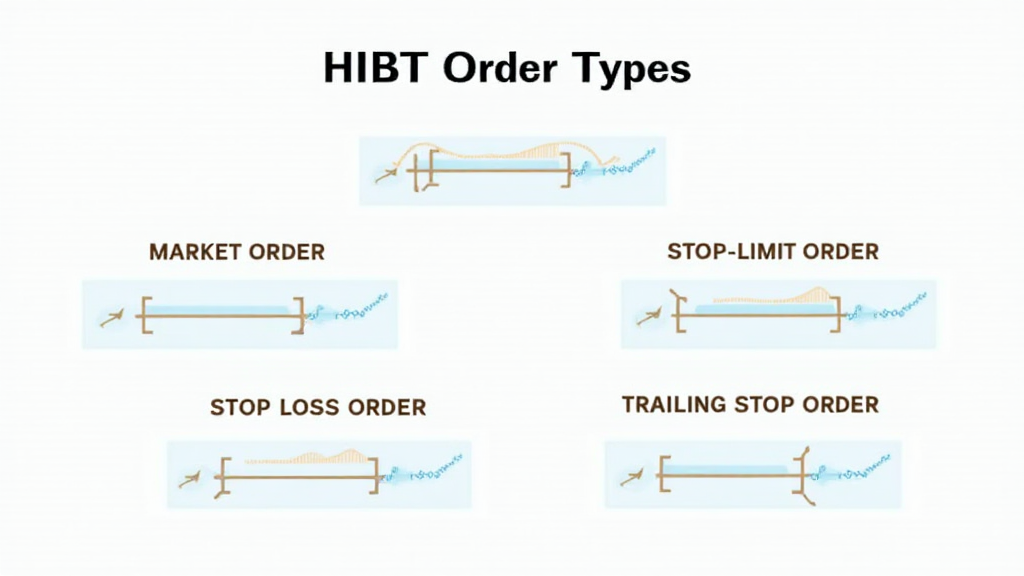

What are HiBT Order Types?

The HiBT platform, one of the emerging forces in cryptocurrency exchanges, offers various order types designed to cater to traders’ diverse needs, from novices to seasoned experts. Understanding these order types will not only enhance your trading experience but also improve your decision-making skills.

- Market Orders

- Limit Orders

- Stop-Loss Orders

- Stop-Limit Orders

- Trailing Stop Orders

Each of these order types serves a specific purpose, allowing traders to implement unique tactics relevant to market conditions.

1. Market Orders: The Basics

A market order is an order to buy or sell an asset immediately at the best available price. This type of order is one of the simplest and most commonly used by traders. For example, when you place a market order to buy Bitcoin, you are stating that you want to purchase at the current market price.

A market order is advantageous because it guarantees that the trade will be executed swiftly. However, traders must be aware that market prices can fluctuate dramatically, which might result in a less-than-ideal price at the time of execution.

2. Limit Orders: Precision in Trading

Limit orders provide traders with the ability to set the price at which they want to buy or sell an asset. For instance, if you wish to buy Ether at $2,500 but the current market price is $2,600, you can place a limit order for $2,500. The order will execute only when the price hit your specified limit.

This order type is beneficial for those who are not in a rush to execute their trades and prefer more precise control, allowing them to buy low and sell high.

3. Stop-Loss Orders: Protecting Your Investments

Stop-loss orders are crucial for managing risk in trading. By setting a stop-loss order, you specify a price at which your asset will automatically be sold to prevent further losses. For example, if you own Bitcoin purchased at $40,000 and you set a stop-loss at $38,000, the order will execute automatically if Bitcoin falls to $38,000, thereby limiting your loss.

This order type acts as a safety net for traders, allowing them to minimize losses without requiring constant market monitoring.

4. Stop-Limit Orders: Combining Strategies

A stop-limit order merges features of both stop orders and limit orders. As with a stop-loss order, a trader sets a stop price that triggers the order. However, unlike a stop-loss order, once the stop price is reached, the order becomes a limit order and will only execute at or above the specified limit price.

This functionality is advantageous when you want to ensure that a position is sold at a minimum price level after being triggered. The versatility makes stop-limit orders popular among proactive traders.

5. Trailing Stop Orders: Locking in Profits

Trailing stop orders allow traders to set a stop-loss order at a percentage or dollar amount below the market price. What makes this order unique is that it adjusts as the market price increases. For example, if you set a trailing stop at 10%, and the market price of Bitcoin rises from $40,000 to $45,000, the trailing stop order will adjust to $40,500.

This feature enables traders to lock in profits while allowing for further gains as the price continues to increase, making it an effective strategy for trending markets.

Backtesting HiBT Order Types

Traders can utilize backtesting methods to analyze the effectiveness of different order types on the HiBT platform. By applying historical market data and simulating trades using specific order types, traders can evaluate potential outcomes and refine their strategies accordingly.

- Data Analysis: Historical data must be collected and analyzed thoroughly.

- Strategy Development: Set clear objectives to test and develop various strategies.

- Performance Metrics: Calculate metrics such as the win rate and average profit/loss to assess performance.

This robust approach can enhance a trader’s understanding of market behavior and increase their proficiency with HiBT order types.

Future Trends in Crypto Trading and HiBT Order Types

As the cryptocurrency landscape continues to evolve, traders must remain vigilant and adaptable. The rapid advancement of technology, coupled with regulatory developments in countries like Vietnam, presents both challenges and opportunities.

For instance, Vietnam has witnessed a remarkable growth rate of user engagement in cryptocurrency platforms, boasting an increase of over 300% in the past year. This trend highlights the nation’s burgeoning interest in digital assets and the need for sophisticated trading tools, including the effective use of HiBT order types.

Conclusion

Understanding HiBT order types is essential for anyone keen on optimizing their trading strategy within the cryptocurrency market. By leveraging different order types, traders can manage risks effectively, maximize potential gains, and navigate the intricacies of digital asset trading.

In summary, whether you’re using market orders for quick executions or trailing stop orders for maximal profit retention, becoming proficient in these techniques will pave the way for success in your trading journey. Remember, mastering these tools depends not just on knowledge but also on making the right decisions tailored to market dynamics.

For more information on how to improve your trading experience, visit hibt.com, and stay ahead in the continually evolving crypto space.

— Dr. Alex Thompson, PhD in Blockchain Technology, author of numerous research papers on crypto trading strategies, and lead auditor for several corporate blockchain projects.