Understanding Crypto Liquidity Pools: Unlocking the Future of Decentralized Finance

With over $4.1 billion lost to DeFi hacks in 2024, the need for robust and secure systems in the blockchain space has never been clearer. As the world shifts toward decentralized finance (DeFi), one cannot overlook the importance of crypto liquidity pools. These pools are revolutionizing how assets are traded and managed, providing opportunities for both investors and traders alike.

This article delves deep into the mechanics of cryptocurrency liquidity pools, the role they play within the DeFi ecosystem, and how to navigate this evolving landscape effectively.

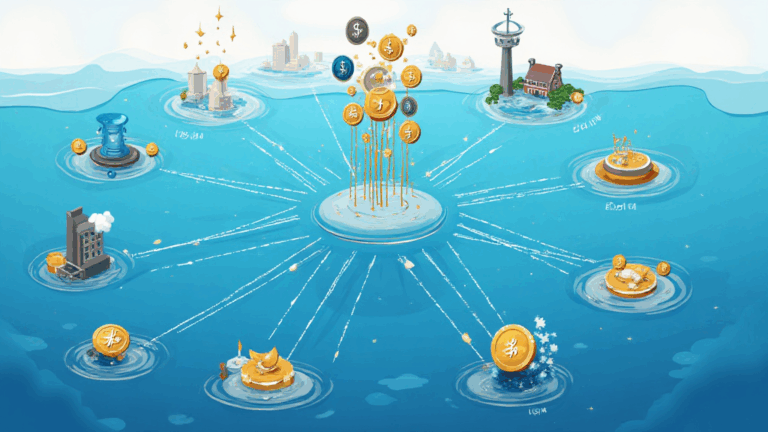

What are Crypto Liquidity Pools?

A crypto liquidity pool is essentially a smart contract that holds two or more tokens in a decentralized exchange (DEX). Unlike traditional exchanges that rely on order books, liquidity pools use automated market makers (AMMs) to facilitate trading. Users can provide liquidity by depositing their assets into these pools and, in return, earn transaction fees.

- Decentralization: No intermediaries are necessary, as trades occur directly through the blockchain.

- Ease of Access: Users can provide liquidity with minimal barriers to entry.

- Economic Incentives: Liquidity providers earn a share of the fees, which can lead to significant passive income.

Importance of Liquidity in Cryptocurrency Markets

Liquidity is a critical aspect of any financial market, as it determines how easily assets can be bought and sold without dramatically affecting their prices. In the crypto space, the emergence of liquidity pools addresses several key challenges:

- Price Stability: Higher liquidity reduces volatility, leading to more stable prices.

- Market Efficiency: Liquidity pools ensure that trades can occur quickly and with minimal slippage.

- Inclusivity: They democratize trading, allowing everyone to participate on equal footing.

How Liquidity Pools Work

To understand how liquidity pools function, let’s break down the process:

- Liquidity Provision: Users deposit tokens into the pool, locking their assets in a smart contract.

- Trading: Other users can trade tokens using the pool, relying on the AMM algorithms to set prices based on existing liquidity.

- Yield Generation: Liquidity providers earn fees based on their contribution to the pool, which can be reinvested for greater returns.

For example, if someone deposits 1 ETH and 200 DAI into a liquidity pool, they are providing both assets to facilitate trades between ETH and DAI, and in return, they receive pool tokens that represent their share of the liquidity.

Benefits of Using Liquidity Pools

Crypto liquidity pools offer several advantages, including:

- Passive Income: By providing liquidity, users can earn fees without actively trading.

- Diversification: Investors can provide multiple asset pairs to spread risks.

- Lower Barriers: Users don’t need vast amounts of capital to make an impact in a liquidity pool.

Risks Associated with Liquidity Pools

While liquidity pools are an attractive investment option, they also come with risks:

- Impermanent Loss: This occurs when the price of the deposited tokens changes compared to when they were deposited. The more significant the price divergence, the greater the loss.

- Smart Contract Vulnerabilities: If the smart contract contains bugs or is hacked, users may lose their funds.

- Market Fluctuations: The volatile nature of the crypto market may affect the overall profitability of holding tokens in a liquidity pool.

Adding Liquidity to Pools: Step-by-Step Guide

If you’re looking to become a liquidity provider, follow this straightforward process:

- Choose a decentralized exchange (DEX) that supports liquidity pools, such as Uniswap or SushiSwap.

- Connect your crypto wallet to the DEX.

- Select the liquidity pool you wish to join.

- Deposit the required assets (make sure to provide both tokens if needed).

- Review fees and potential returns before confirming.

Liquidity Pools in the Vietnamese Market

The Vietnamese crypto market is rapidly expanding, with an estimated user growth rate of 30% year-on-year. This growth presents a significant opportunity for liquidity pools:

- Increased adoption increases the demand for liquidity.

- The Vietnamese regulatory environment is gradually becoming more favorable for DeFi projects.

As the market matures, more Vietnamese users are looking at ways to engage with liquidity pools for both passive income and trading strategies.

Best Practices for Maximizing Your Returns in Liquidity Pools

If you want to optimize your investment in crypto liquidity pools, consider the following tips:

- Analyze Pair Performance: Choose pools with tokens that have proven historical price stability.

- Monitor Impermanent Loss: Regularly assess your position to minimize potential losses.

- Diversify Your Pools: Don’t put all your assets into one pool; spread your investments across multiple pools.

Conclusion

Cryptocurrency liquidity pools represent a revolutionary shift in the way assets are traded and managed in the DeFi ecosystem. With the right knowledge and strategy, participating in liquidity pools can provide substantial benefits to both novice and experienced investors alike. As the Vietnamese market continues to grow, now is the perfect time to explore these opportunities and understand their complexities.

While risks exist, the potential for rewards makes crypto liquidity pools a compelling component of decentralized finance. As always, remember to do your due diligence and consult local regulations before diving deep into the world of DeFi.

For more resources and guidance on navigating the crypto landscape, visit cryptomindsethub.